ODPL: A First Hand Account of a Brazen Crypto Scam

Now, people can use your name to promote a crypto scam while you're asleep — and that's over before the next morning.

On January 28th, over the course of about two hours, about 17,000 people bought into a "meme-coin" called $ODPL, with about $23 million changing hands. The coin was launched by a post on X from the account of Stefaan Verhulst, a professor at New York University who works on open data policy and runs an organization called The Governance Lab. His alleged collaborator on this $ODPL coin? Yours truly, David Troy.

This, of course, was news to me. I woke up in the middle of the night and checked my phone, as happens more often than it should. I was surprised to find people messaging me on multiple platforms (X, email, LinkedIn) asking if I was part of this $ODPL coin, because it was "blowing up." I sent a flurry of terse messages and replies saying, "This is a total fraud. Nothing to do with me."

Now, to find out what was in fact going on. The bio of an X account called "OpenDataPolicy" which had been created a few days earlier said, "The Open Data Policy Lab, founded by @sverhulst and co-founded by @davetroy advances responsible data use and open sharing for AI innovation." Nice tagline, but as far as I could remember I hadn't launched anything new with Mr. Verhulst.

But I did get a direct message from Verhulst a day prior, and I've known him for about ten years. I consulted with him on a project and invited him to speak on open data topics at TEDxMidAtlantic in Washington D.C. in 2016. So we are friendly.

The message read, "Dave, I'm launching a new program called @OpenDataPolicy, founded to advance the responsible use and open sharing of data, driving transparency and smarter policies in Al and beyond. Would it be possible for you to follow and share to help spread the project?—appreciate all help you can provide!" Thinking I was doing a favor for a colleague and seeing that the account was also followed by some mutual friends of ours, I followed @OpenDataPolicy. "Sure, I'll check it out," I replied. I figured that was the end of it.

But on the 28th, that account posted the following message, "We're launching a fundraiser to drive responsible data use and transparency in Al. Your contributions will help unlock datasets, improve accessibility, and support responsible data sharing. To make these pillars a reality, we're launching a token to raise funds to advance open data, improve accessibility, and promote responsible data sharing," along with a unique crypto coin identifier. They also added my name to the @OpenDataPolicy account bio. The scam was off to the races.

The scammers had hacked Verhulst's X account, enabling them to send me the request to follow OpenDataPolicy. And they directed memecoin-trading "crypto degens" to another post on Verhulst's account that validated @OpenDataPolicy and the coin. So when the traders went to investigate whether the $ODPL coin was "real" or a so-called "shitcoin," they saw Verhulst's name, a credible professor at NYU, coupled with my own and my various bona-fides. And they saw that I was following the @OpenDataPolicy account. So for about an hour, $ODPL was the perhaps the "realest" meme coin on Solana — the same crypto platform on which the $TRUMP and $MELANIA were launched about a week before.

Given my personal views on crypto, it's remarkable that anyone would think that I would endorse a meme coin of any kind, even for a worthy cause like Verhulst's work. And in fact, earlier the same day, I had published an article here on America 2.0, No Limits: Crypto Scams Set to Proliferate in 2025. Perhaps finding this article inconvenient to the $ODPL cause, someone found it necessary to try to nuke the America 2.0 website — which went down during this debacle.

Crypto degens move in herds. One analyst who follows the space more closely than I do told me, "You have to understand the mindset of the average crypto trader. It's just a video game for them. All they look at is the ticker chart. They don't look for any other sources of information. If it's going up on dexscreener [a popular crypto coin data site] then they just buy in for the ride." But once the pump is up and running, more people pile on, which tends to invite additional scrutiny.

A few smart degens noticed that my account had said nothing about ODPL or Verhulst and raised this as a red flag. They also bothered to take a minute to look at my consistent record of being an unabashed critic of all things crypto. After the first hour, these doubters had started to erode confidence. My subsequent weighing in saying, "this is a fraud, stop it," also threw cold water on the fun. By the end of hour two, users on X were accusing Verhulst and me of scamming them and running off with their money. I explained that they were insane; a few reality-based degens agreed that I was in fact an honest person and telling the truth. And with that, $ODPL was all but dead.

I emailed Verhulst to ask what was going on and if he knew anything about this, and went back to sleep, as best I could. I saw his reply in the morning. "What should I do?," he asked. He recovered his X account and posted a statement explaining that his account had been hacked, disavowing all knowledge of the $ODPL scam. I did the same, quoting his statement.

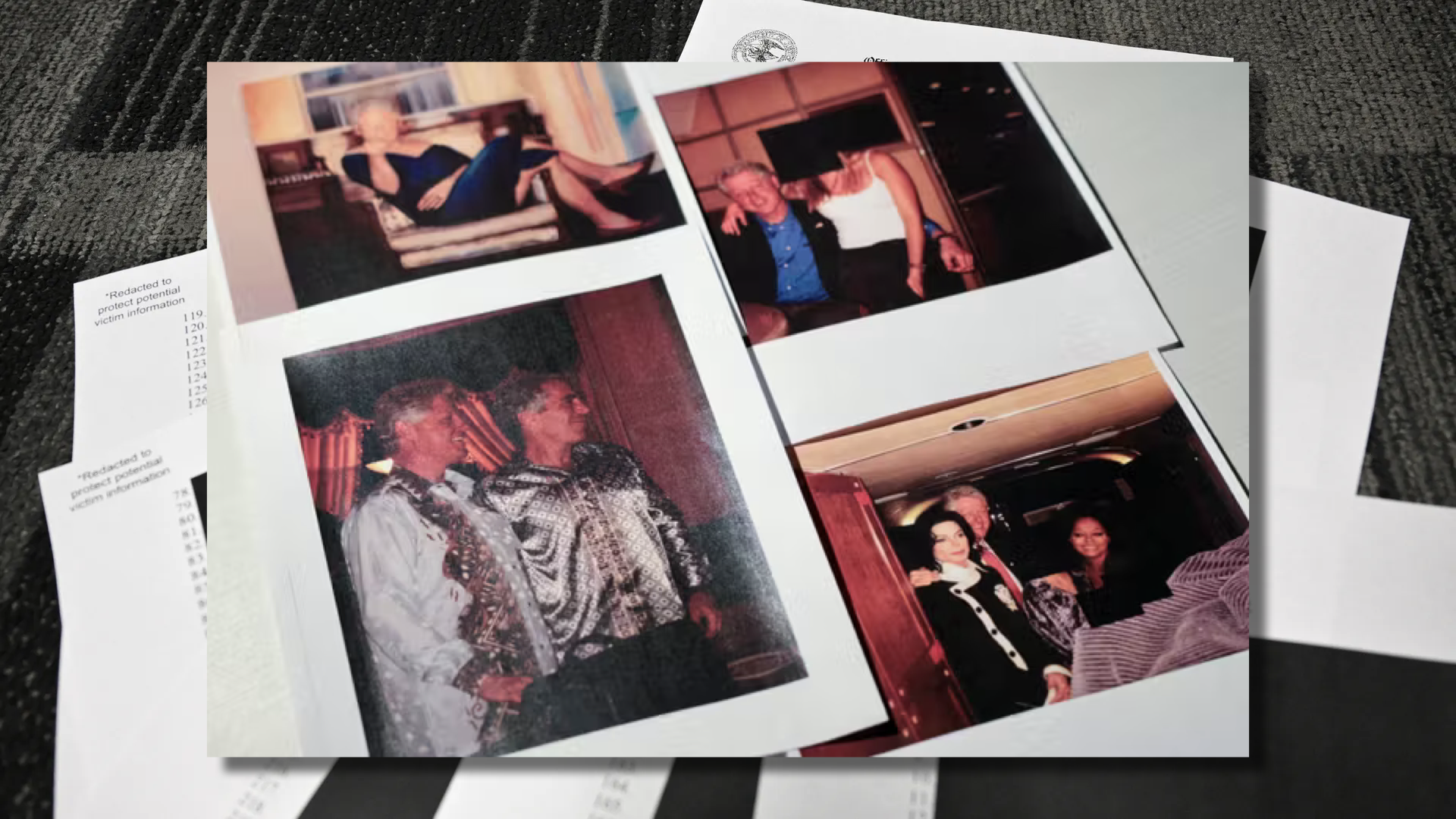

But what exactly happened here? As best we can tell, roughly 17,000 traders bought into $ODPL and rode it up — with some making profits because they sold before it collapsed. About $23 million went in — and went out. The coin achieved a market capitalization of around $12 million at its peak. And the person (called a "dev," for developer) who ran the scam appears to have netted approximately $69,000. Not a fortune, but not bad for a couple hours work and a bit of light social engineering; it would pay off many people's student loans. Consider how much they might have profited had I not awoken to check my phone.

Imagine my surprise to see a day later that TIME Magazine had posted on its X account that it, too, had launched a meme coin, called $TIME. Given that the magazine is now owned by Musk ally Marc Benioff, it wasn't clear immediately if this was real or not. In the current environment, anything is possible. The post read, "Introducing $TIME on Solana. For over a century, TIME Magazine has documented history. Now, we’re embracing the future with $TIME, a digital asset built on Solana to enhance engagement, access, and community participation. The future of media starts now. Own a piece of $TIME," again with a unique token identifier.

Many immediately suspected TIME had been hacked. The X account attempted to allay that concern by making another post asserting that no, they had not in fact been hacked, and that they really had launched a meme coin. Within minutes, all of the coin-related posts had been deleted. The coin was never real. TIME's X account had been hacked. But it reached a $13.68 million market cap, and the "devs" (there were many) cleared about $1.9 million in total.

So why the sudden explosion in nonsense meme coins? Trump's own $TRUMP and $MELANIA coins have set the example for brazen fraud and others are understandably following his lead — particularly young men with too much time on their hands who would rather gamble than get a real job. We're also entering an era where there will be no securities enforcement. As I've previously reported, the administration seeks to treat meme coins as collectibles rather than securities, opening the door to large scale fraud for nearly any purpose under the sun. It's likely also that the SEC's days are numbered, even if they did choose to regulate this.

Reputations and trust are now extractive resources; expect them to be mined by attackers and scam artists. TIME Magazine, while not what it once was, is enough of a brand to milk out nearly $2 million in a few hours. An NYU professor with 5,000 followers and me, with around 200k followers across a handful of platforms, will only apparently net you about $70 thousand. Especially if it gets killed in two hours.

Elections matter, and this is what the American people have chosen. We are likely to see a wave of unending Ponzi schemes that corrodes government, industry, society, and family that will last until we make it stop — or die trying. This is America in 2025.

Update: On February 3rd, the X account of Nobel Prize winning journalist Maria Ressa was hacked in support of an identical meme-coin crypto scheme, also based on the Solana blockchain. The posts were quickly spotted as fraudulent and removed within minutes, however Ressa's account appeared to undergo a second hack a day later.

Additional Suggested Reading