Your idiot nephews are going to wreck your retirement. Stop them.

Young men are drawn to the allure of getting rich in cryptocurrency like a moth to flame — but if they actually do, it will be at our collective expense.

This holiday season, you have the opportunity to educate your family members about the strange tale of something called "MMM," a series of financial frauds that caught on like wildfire in Russia. First launched by Sergei Mavrodi in 1989, MMM operated openly as a Ponzi scheme, which earned him a conviction and imprisonment.

In 1994, Mavrodi was released from prison and elected to a deputy position in the State Duma, giving him immunity. He restarted the MMM scheme, and it ran again until 1997, when Mavrodi declared MMM bankrupt.

After a period in hiding and then another arrest and imprisonment, he returned in 2011 with "MMM-2011," peddling "Mavro Currency Units." The purpose? To get rich. "It is a naked scheme, nothing more," he said. "People interact with each other and give each other money. For no reason!" And people did make money on MMM — lots of it. Authorities were slow to intervene, as Ponzi schemes were no longer illegal in Russia.

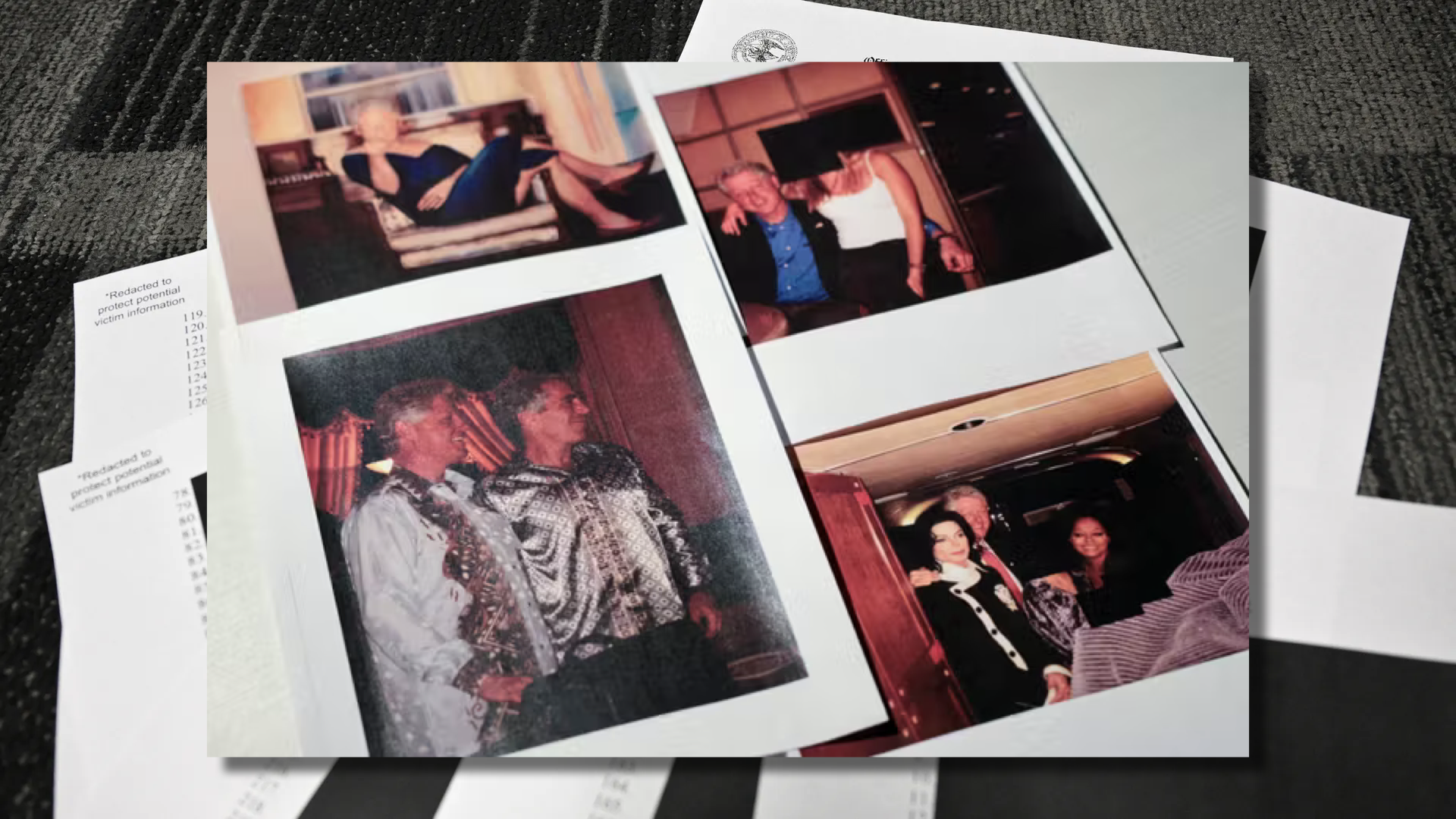

MMM ads from early 90's, offering the promise of riches and material wealth. (YouTube)

In 2012 Mavrodi told RFE/RL, "My goal is a financial apocalypse, a destruction of the global financial system. I consider the current financial system unfair; it's not fair that some people own billions while others have nothing. The system must be destroyed and something else must be built in its place. That's precisely what I'm working on."

Mavrodi died in 2018 at age 62 — but his dream of collapsing the current financial system lives on. For Putin and Musk have picked up Mavrodi's baton.

§

Fast forward to today, and it's hardly possible to go ten minutes without a man (and yes, it's almost always men, or occasionally the women who follow them around like remora) going on about the price of Bitcoin (which is hovering around $100,000) and its profound consequences.

What makes it especially profound is they don't have a real job and are trying to steal your retirement. Of course, they don't realize this. They think they are investors who are enlightened and helping to seed the next-gen version of the financial system.

But increasingly, folks are waking up to the fact that Bitcoin, like MMM before it, adds nothing to GDP because nothing is made. To the extent that anyone profits from activity associated with buying and selling Bitcoin, it is extracted from other sources of productivity. Thus, Bitcoin sets up a zero-sum game between holders and non-holders. People profiting on Bitcoin trading necessarily do so at the expense of everyone else — in part by eroding the value and purchasing power of the dollar itself.

More people are arriving at the conclusion that Bitcoin is necessarily toxic.

A recent European Central Bank paper titled The Distributional Consequences of Bitcoin concludes, "non-holders should realise that they have reasons to worry about Bitcoin and legislation favouring it. Latecomers and non-holders and their political representatives should emphasize that the idea of Bitcoin as an investment relies on redistribution at their expense. Failing to do so could skew election results in favour of politicians who advocate pro-Bitcoin policies, fuelling the division of society."

Financial Times contributing editor Brendan Greeley goes on to add in a recent piece, "A long-term bet on bitcoin is bullish on the permanent collapse of all institutions, everywhere. It’s a nuclear put."

Responding to proposals by Senator Cynthia Lummis to establish a US Strategic Bitcoin Reserve, Greeley says, "The strategic bitcoin reserve is not a resilience strategy for the US. It’s a resilience strategy for the hodlers. [internet slang for holders of Bitcoin]"

So you can't simply ignore Bitcoin. Unlike with Bernie Madoff, tulip mania, or a typical Ponzi scheme, you can't simply not participate and hope to be secure. If you want to minimize harm, you need to help kill it. And it can be killed, despite protestations of the Bitcoin Bros — it will just be very hard work.

- Fight crypto interests in politics. In the 2024 cycle, crypto interests injected upwards of $200 million total into backing politicians in both parties. While Republicans generally have a more pro-crypto stance, crypto companies are ready to primary any Democratic candidate who doesn't fall in line.

- Tax Bitcoin and derivative transactions like Wildcat Banks. This isn't the first time we have had to deal with this problem. The 'greenback' was conceived as a standardized dollar after a big crackdown on predatory Wildcat Banks in the 19th century. A hefty tax on them put an end to the practice.

- Educate your nephews and encourage them to get a real job. This holiday, you have an opportunity to speak up. Wear protection — you will elicit an interminable firehose of unmitigated bullshit in response to any logical argument against Bitcoin. Most of it will boil down to "you just don't get it." Tell them yes, you don't get why they want to capture the government and drain your 401(k). Because it's antisocial, antidemocratic behavior.

Slouching Towards Collapse

As if this wasn't disturbing enough, Russia's strategic goal is to wreck the dollar by bringing about financial collapse — as soon as January. Bitcoin helps serve this purpose; so does a potential US debt default (bankruptcy), which Musk (who is serving as Putin's proxy) is pushing nonstop. Musk has also promised that his "Department of Government Efficiency" may cut essentially all of the Federal discretionary budget — also prompting economic collapse.

Trump's cabinet picks are also friendly to crypto interests. Howard Lutnick, tapped to head the Commerce Department, is a major money manager for and stakeholder in Tether, a so-called "stablecoin" that backstops the price of Bitcoin. Treasury nominee Scott Bessent is also considered extremely friendly to crypto interests.

America is currently headed for bankruptcy super fast https://t.co/Tm6JFJ6mef

— Elon Musk (@elonmusk) November 23, 2024

Provoking a financial meltdown is explicitly part of Putins' plan (see Project Russia) to take strategic control of the United States. I prepared this white paper a few days ago to help people grappling with what to do with their assets. I am not a financial advisor and this is not financial advice. It is, however, accurate warfare intelligence. Share with your own advisors accordingly.

And if you get a chance this holiday season, tell your friends and family that crypto profits come at the expense of everybody else. If they want to live in a supranational autocracy run by Putin and Musk, keep this up. Otherwise, they should reorient their priorities around producing real value in the real world.

For more history on this topic please see:

Paranoia on Parade: How Goldbugs, Libertarians and Religious Extremists Brought America to the Brink, by Dave Troy, June 27, 2022.