Lawmakers Eye Plan to Abolish Debt Ceiling in 2027

The debt ceiling has been a source of constant political gamesmanship. A bipartisan chorus of lawmakers is finally calling for its elimination.

With Donald Trump's July 4 signing of HR 1 (his so-called “Big Bill”), the nation's debt ceiling has been raised by $5 trillion. Estimates vary slightly, but this increase will likely mean that we will not face another debt ceiling battle until at least 2027 — well after the 2026 midterms.

America 2.0 has been closely following the debt ceiling issue because it is the primary fault line running through the MAGA coalition. The libertarian, Russia-aligned faction doesn't want to raise the debt ceiling because they see it as fiscally irresponsible — and it gives the US carte blanche to send aid to Ukraine and prolong dollar hegemony. Many Republicans, however, may talk about fiscal responsibility but are primarily interested in retaining power and maintaining the status quo.

This conflict is what led Rep. Thomas Massie (R-KY) to vote against HR1. It has also prompted Elon Musk to create the America Party, as a challenge to what he's calling the uniparty, rooted in his perception that Republicans and Democrats are both fiscally irresponsible and willing to spend Americans into so-called “debt slavery.”

However, it's difficult to imagine Musk losing sleep over US government debt — which is really just treasury bills held by a broad range of investors. Fear-mongers like to invoke the idea that shadowy bankers are bankrupting America and inciting foreign wars to line their pockets. But these are antisemitic tropes descended directly from the Protocols of the Elders of Zion.

Facts vs. Myths about US Debt

The reality (according to the Treasury's Fiscal Data website) is that about $20 trillion of US debt is held by the public and institutional investors as treasury bonds. These investments provide stable returns and the US can continue to issue them as long as there is a market.

One persistent myth is that China owns the bulk of American debt. This simply isn't true: China owns only about $760 billion, and lags Japan, which holds about $1.1 trillion. Combined, foreign holdings in US bonds only account for about 25% ($9 trillion) of the total. Intra-governmental domestic debt (such as Social Security, Medicare, and federal retirement funds) account for another $7 trillion.

We've issued a lot of bonds, and they are popular products. But the US is not a business, and we are not at risk of “bankruptcy” or “debt slavery” — that is, unless we intentionally default on our debt, which is what would happen if we fail to keep raising the debt ceiling.

The United States government is also not a business and we should ignore calls to run it like one. We should optimize for well-being, employment, and minimal but non-zero (around 2%) inflation. According to Stephanie Kelton, one of the leading economists arguing against debt austerity and a champion of Modern Monetary Theory, suggests (in her book, The Deficit Myth) that debt issuance is simply cash that hasn't been taxed out of the economy yet. And the decision to do that should be based on real performance metrics, not dogmatic notions of debt as sinful.

Ultimately, we should do what's necessary to ensure that the dollar retains its status as the world's reserve currency. Stability, transparency, and the rule of law are far more important than the volume of bonds we may issue at any given time, especially when debt volume is considered relative to Gross Domestic Product (GDP), which spiked upwards in 2020, but is similar to levels last seen at the end of World War II.

Why have a debt ceiling?

The United States never had any sort of debt ceiling until 1917, with the passage of the Second Liberty Bond Act, which authorized a second round of sales of Liberty Bonds to fund US efforts in World War I. This imposed a total bond issuance limit of $15 billion. The total debt ceiling has been raised statutorily periodically since then, but the very existence of such a limit is a kind of Chekhov's gun that now threatens global stability every time it comes up, given the volume of outstanding US debt instruments.

Critics also argue that the debt ceiling is unconstitutional, as the 14th Amendment Section 4 says, “the validity of the public debt of the United States...shall not be questioned.” However, the 14th Amendment was passed in 1866, and many believe that phrase was intended in the context of reconstruction after the Civil War.

Accordingly, many legal scholars believe that running up against the statutory debt ceiling might provoke a constitutional crisis, while economists observe that debt ceiling worries provoke market panic and uncertainty.

To reduce such uncertainty, President Trump and Senator Elizabeth Warren have both recently advocated for the elimination of the debt ceiling altogether. The idea is gaining traction in the House, too.

According to the Washington Post, Brendan Boyle, the leading Democrat on the House Budget Committee seeks to lead an effort to eliminate the debt ceiling in 2027, when he expects that Democrats will have regained control of the House. Boyle proposed similar legislation in 2023 called the “Debt Ceiling Reform Act,” which was not passed.

Rep. Tim Burchett (R-TN), a Trump ally and a leading conservative voice in the House, has also agreed that the debt ceiling's days are behind us, telling reporters on July 3, “I feel like we ought to just do away with the debt ceiling. I mean, it’s a joke.” Burchett had previously voted against raising the debt ceiling four times, under both Presidents Trump and Biden.

And given that only Rep. Massie and Rep. Brian Fitzpatrick (R-PA) voted against Trump's big spending package, it's unclear that the debt ceiling is a serious concern for Republicans, relative to other priorities. A proposal to eliminate the debt ceiling may finally have enough bipartisan support in 2027 to win the day.

Up Next: Libertarian Exit and Continued Tariff Uncertainty

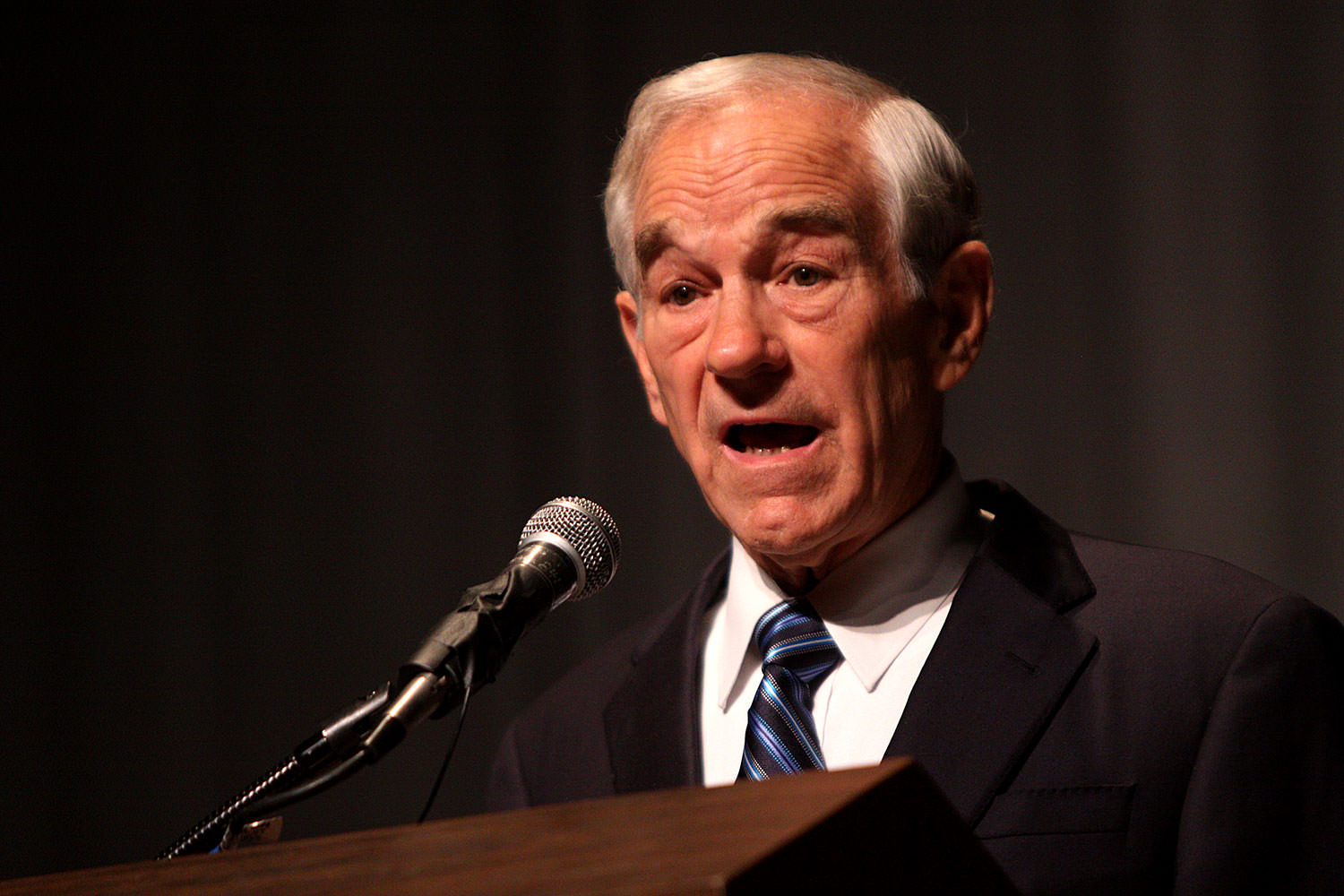

Now that the debt ceiling has been raised, expect Russia to work two fronts simultaneously, trying to extract what it still can out of Donald Trump's scattershot term while also trying to build up a robust libertarian “anti-war” faction seeded around Rep. Massie, Sen. Rand Paul (R-KY), Ron Paul, the LaRouche (Schiller Institute) network, and Elon Musk's America Party.

Putin appears to be on his back foot amid reports that Trump and Zelenskyy have discussed the possibility of using NATO-provided ATACMS missiles to strike deep into Russia, including Moscow and St. Petersburg.

While Trump's tariff fiasco is a far cry from what Putin and his proxies might have wanted from a real debt ceiling standoff (leading to massive spending cuts, or even better, an actual default crisis), it is helping to isolate the United States, which is an important strategic goal. Trump's recent announcement of a new 10% tariff against BRICS countries and 100% secondary tariffs against Russia and its trading partners further removes the United States from Russia's sphere of influence while making those countries more internally resilient.

And though we have dodged the bullet of a messy debt default standoff, the dollar is down about 11% since January 20, and inflation is up 2.7% over last June, under pressure from tariffs. If Vladimir Putin hoped to bring about an abrupt end to dollar hegemony using the debt ceiling as leverage, he may simply need to be patient and let the tariffs do their work. ◼

Additional Suggested Reading